If you mention cloud solutions to most people in the financial services industry today, you’ll probably elicit a crinkled-nose expression and a response like, “Not in my industry, it’s not secure enough for finance.” We can’t blame them for feeling that way, especially in a time when data breaches are at an all-time high. More specifically, with high-profile data breaches targeting entities in the financial services sector like Citibank (2011), JP Morgan Chase (2014), and more recently Equifax(2017), it is no surprise why the industry is apprehensive of taking that leap into the cloud.

However, it’s important to remember that “cloud” doesn’t mean data floating out in the atmosphere above our heads. In actuality, cloud is a service where you trust data to a company whose responsibility it is to protect the data of others. While giving over your data to another company may sound just as scary as letting it float over your head, know that not all cloud service providers are created equal. There is one cloud service that is not only secure but is more secure than the legacy systems upon which most of the industry operates on-premises: Microsoft’s Azure Cloud Services.

In addition to more robust security protocols, Azure offers a myriad of additional benefits to businesses in the financial services sector. Here are five reasons why the financial services industry should let go of their trepidation's, and consider Azure Cloud Services.

1. Azure is secure

Sure, it can be daunting to think about your organization’s precious data stored in a tiny piece of silicon in a server somewhere far, far away, but rest assured, Microsoft has your data on lockdown, even when it is in transit.

When your data is in transit, Azure offers the tried-and-true industry standard: Transport Layer Security (TLS, also known as SSL/TLS). For those unfamiliar with cryptographic protocols, TLS operates at the transport layer to connect your PC’s web browser (where Azure services are accessed) to the physical web server where your data is stored. TLS creates a secure connection that provides privacy as well as data integrity between both communicating computer applications.

When your data is at rest, Azure gives you the option to lock it up with the Advanced Encryption Standard (AES). AES encryption is strong, incredibly strong in fact. To put things into perspective, a brute force attack that could decipher DES-encrypted data in a matter of seconds would take billions of years to decipher an AES-encrypted cipher. AES is so reliable that the United States government employs AES to protect its most sensitive data.

With data security options such as TLS and AES encryption, Azure is ensuring that your data is protected by the most reliable security protocols in the industry.

2.Azure is flexible

If you’re still not entirely convinced about the robustness of Azure’s top-notch security options, you don’t have to commit all of your organization’s data to the cloud. Azure offers hybrid cloud solutions that allow you to choose what data gets stored on-premises, and what goes to the cloud. In other words, Azure customers are still able to reap most of the benefits of cloud services by keeping their most sensitive data on-site while moving the rest of their data to the cloud. What is more, Azure gives customers the option to move data back and forth between on-premises and cloud storage as they see fit. Thus, businesses in financial services could still see great benefits without having to go full cloud. With Azure, they can integrate cloud services at the level of comfort that makes sense to their business, and most importantly their own customers.

3. Azure is resilient

With the economies across the world heavily reliant upon the daily operations of the financial services industry, a site outage, blackout, or any other catastrophic disaster could take weeks (perhaps months) to recover from. If you’re worried about the negative repercussions of such an event, Azure has you covered.Instead of dealing with the exorbitant amount of time, materials, and expenses of maintaining a backup data center, Azure offers solid site recovery options that allow you to spend more time focusing on growing and maintaining your organization instead of devoting time and valuable resources to a disastrous event that may or may not come. With orchestrated disaster recovery as a service (DRaaS), Azure facilitates the creation of custom disaster recovery plans that can be as simple or as complex as your business requirements demand. You may not always be able to control what happens to your business, but with Azure, you can control how quickly your business recovers from unplanned setbacks without all the hassle, and expense of maintaining a remote datacenter.

4. Azure is global

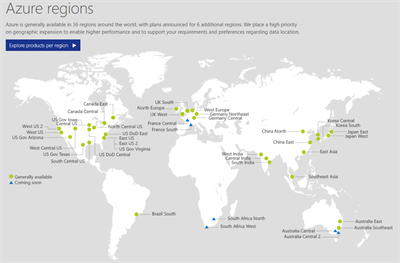

Azure’s data consenters span across 36 regions globally (as shown below). As globalization continues, intranational borders are fading while financial institutions are cascading past these borders at record speed. For a global financial institution to run multiple data centers across the world is no longer a competitive advantage, it is cardinal to their survival. Azure’s expansive influence facilitates growth and business expansion all the while making great user experience and computational performance independent of geographic location.

5. Azure is compliant

Since the Global Financial Crisis of 2008, most would agree that no industry has been under more heavy vigilance and scrutiny than financial services. When doing business in financial services, compliance is key. Azure boasts the most comprehensive compliance coverage of any of the top cloud service providers. In fact, it has earned more certifications than any other cloud provider, making it the industry leader for customer advocacy and privacy.

Among the most notable of Azure’s long list of certifications are the ISO/IEC 27018 and the IRS 1075.ISO/IEC 27018 mandates that Azure customers know where their data is stored, that customers are assured that their data will not be used for marketing or advertising without their consent and that Microsoft will only comply with legally binding requests for disclosing customer data. The IRS 1075 provides guidance to government agencies that access federal tax information (FTI) to ensure best practices that protect confidentiality. This aims to minimize the risk of data breaches as well as the misuse of FTI.

Now that you know how secure, flexible, resilient, global and compliant Microsoft’s Azure Cloud Services are, I implore you to compare these characteristics to your current data management solution. Is your data really safer under your own roof or does it just feel safer because it’s close to you? Take your own advice and stop storing your most precious assets under your mattress, trust your data to someone who specializes in securing it.

Ready to explore cloud solutions? See if you qualify for a free Azure proof of concept by contacting an Azure Specialist at (813) 265-3239.